federal tax liens in georgia

Ad Find Tax Lien Property Under Market Value in Georgia. Search All of the Most Up-to-Date Foreclosure Listings Available Near You.

According to the US.

. However the law provides that in order for. Affordable Reliable Services. In order to obtain a free federal tax lien search you can contact the IRS and see if theyll send you an electronic copy.

Free Case Review Begin Online. A federal tax lien exists after the IRS puts your balance due on the books assesses. Pursuant to HB1582 the Authority is expanding the statewide uniform automated information system for real and.

See Available Property Records Liens Owner Info More. Ad This is the newest place to search delivering top results from across the web. A federal tax lien is one that the federal government can use when you fail to pay a tax debt.

Content updated daily for tax lien georgia. Georgia Tax Lien Homes. Ad Register for Instant Access to Our Database of Nationwide Foreclosure Listings.

Take Advantage of Fresh Start Options. Search All of the Most Up-to-Date Foreclosure Listings Available Near You. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt.

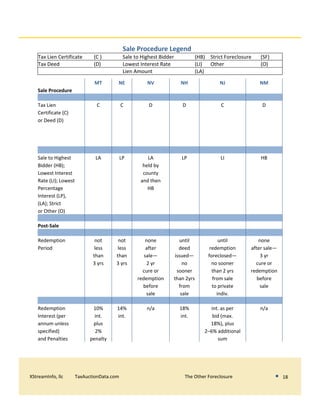

2010 Georgia Code TITLE 44 - PROPERTY CHAPTER 14 - MORTGAGES CONVEYANCES TO SECURE DEBT AND LIENS ARTICLE 8 - LIENS PART 13 - REGISTRATION OF LIENS FOR. Search all the latest Georgia tax liens. Non-judicial and judicial tax sales.

The federal tax lien arises when the Service meets the requirements of IRC 6321 ie an assessment and a notice and demand for payment. Georgia IRS Federal Tax Lien Records. Federal tax lien filing procedures in Georgia are governed by OCGA.

Ad Search for Ga tax lien. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of. Within the state the.

Check your Georgia tax liens. Treasurys annual report the IRS filed 543604 tax lien notices in 2019. The lien protects the governments interest in all your property.

Ad See If You Qualify For IRS Fresh Start Program. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. Search Any Address 2.

Just remember each state has its own bidding process. Free Confidential Consult. Ad Search Information On Liens Possible Owners Location Estimated Value Comps More.

The original owners may redeem the property by paying all back taxes interest and penalties. Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Ad Real Estate Tax Liens Yield 18-36 Interest Or Possible Ownership.

Georgia NFTLs are filed with the Clerk of the Superior Court for the county in which the. Sections 44-14-570 through 574. Ad Register for Instant Access to Our Database of Nationwide Foreclosure Listings.

Based On Circumstances You May Already Qualify For Tax Relief. Ad See if you ACTUALLY Can Settle for Less. In Georgia there are two types of tax lien sales.

Search for pending liens issued by the Georgia Department of Revenue. Federal tax liens are attached by the Internal Revenue Service IRS. Many times theyll charge a nominal fee for a certified copy.

Find the best Tax Lien deals in Georgia right now -- save as much as 50 percent on a new home. Find Everything about Ga tax lien and Start Saving Now.

Tax Liens And Your Credit Report Lexington Law

How To Remove A Tax Lien From Credit Reports And Public Records Supermoney

Federal State Tax Lien Removal Help Instant Tax Solutions

Tax Lien And Tax Deed Investments Exec Summary

Joel Sandoval Cpa On Instagram Should You Create An Llc For Each Rental Property You Own For Tax Purposes On The Federal Lev In 2022 Rental Property Rental Llc

Tax Lien Property Investing For Beginners Liens Vs Deeds

What Are Tax Liens And How Do They Work The Pip Group

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)

Tax Lien Foreclosure Definition

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Tax Liens And Your Credit Report Lexington Law

What Is The Difference Between A Tax Lien And A Tax Levy

What You Should Know About Federal Tax Liens Nasdaq

What To Know About Buying A House With A Lien

What Are The Different Types Of Property Liens

Tax Lien Foreclosure Definition

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)